Agricultural Sales Tax Exemption Now Streamlined

Agricultural Sales Tax Exemption Now Streamlined

On March 20, 2022, Governor Andy Beshear signed Senate Bill 121 enacting a streamlined process for eligible farmers to receive a sales tax exemption on eligible purchases. As this bill was given “emergency” status, the bill became effective upon the Governor’s signature. Although the Kentucky Department of Revenue is still writing the regulations, this article will provide an update to the current standing of sales tax exemption for farmers.

In 2021, the Kentucky Legislature approved a new process for farmers to receive sales tax exemption for eligible purchases. Instead of self-certification, farmers would be required to apply to the Kentucky Department of Revenue to receive an agricultural exemption number (AE). This number would be included on a new Agriculture Exemption Certificate given to retailers. The retailers would maintain both paper and digital copies of the exemption form. The exemption number would be required for purchases beginning July 1, 2022 and would be good for three years from date of issue. Farmers would be required to renew the number prior to expiration.

The recently approved legislation renames the AE as an “agriculture exemption license number.” It can take the place of the exemption certificates to show that the farm is qualified to make qualified farm purchases exempt from Kentucky sales tax. The AE issued to farmers who applied earlier will be their agriculture exemption license number. As with the 2021 legislation, farmers must submit documentation, such as a Federal Schedule F, Federal Form 4835, or other documentation to verify the sales of agricultural products.

The new streamlined bill appears to provide some relief to retailers by eliminating their requirement to maintain an exemption certificate on file.

The license number will be required for qualifying purchases beginning January 1, 2023. Prior to January 1, 2023, a qualified farmer who has not received an AE number may provide the retailer with a fully completed “Streamlined Sales Tax Certificate of Exemption” form, an old Exemption Certificate, or the new Form 51A158 with their Driver’s License number. These forms can be found through the Kentucky Department of Revenue’s Sales & Use Tax Division website.

Unlike the 2021 legislation, the new legislation does not include a deadline for applying for the agriculture exemption license number. However, in order to be exempt from sales tax, the license number must be used on and after January 1, 2023. If a qualified farmer has not yet applied for an exemption number, they are encouraged to do so quickly to allow for plenty of processing time by the Department of Revenue.

The current AE Numbers will expire on December 31, 2026 and renewals will expire after 4 years. If the farmer does not renew their AE numbers, purchases made after those dates will be subject to sales tax, even on qualified farm purchases. The AE Number must be renewed prior to expiration. The Department of Revenue will provide renewal details at a later date. A farmer who ceases the farming business activities that qualified for the sales tax exemption status must notify the Department of Revenue within 60 days.

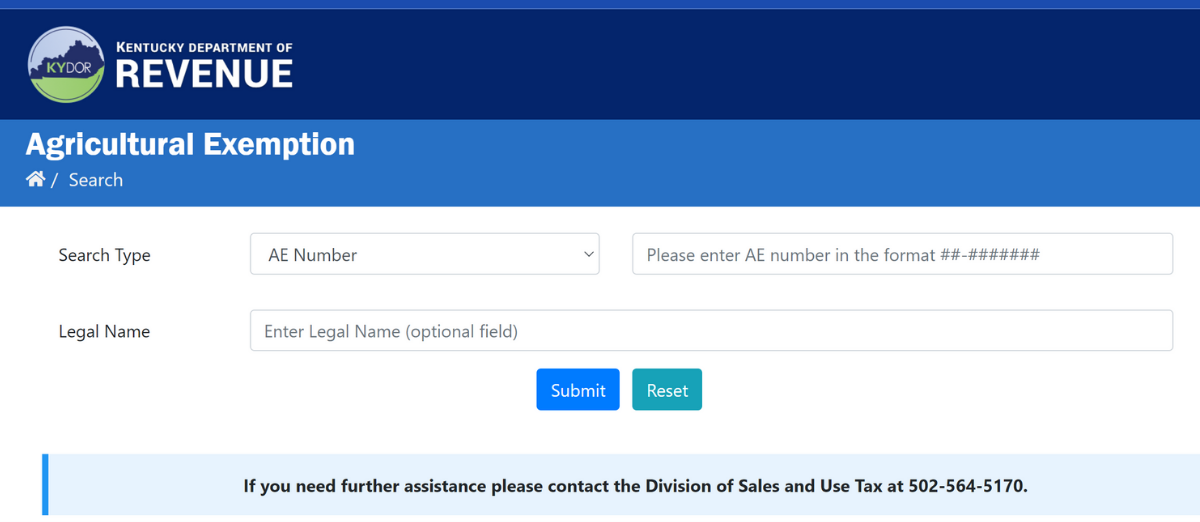

For retailers, the Department of Revenue has established a website to search for approved agriculture exemption license numbers. Browse to revenue.ky.gov and under the Business section, choose “Sales and Use Tax”. There is a link to search for or verify an agriculture exemption number, using a known AE number, a driver’s license, federal EIN, or other options. If a farmer has applied for an AE number, they can also use this search option to see if they were approved for an AE license number, but have not received the confirmation letter.

As a reminder, this article was written prior to the Kentucky Department of Revenue’s completed regulations of the new legislation. Once the regulations are complete, updates will be provided as needed.

Recommended Citation Format:

Powers, L. "Agricultural Sales Tax Exemption Now Streamlined." Economic and Policy Update (22):5, Department of Agricultural Economics, University of Kentucky, May 31st, 2022.

Author(s) Contact Information: